Home insurance discounts are a great way of saving money. Some companies are able to provide homeowners with a small percentage off their premiums, while others may offer free devices. There are many discounts you can choose depending on your specific situation. You can get small discounts by using electronic statements or large savings when you bundle two or more policies.

When your current policy expires, the best time to get a home insurance discount is before it expires. Most companies will send renewal notices 30-60 business days before your coverage ends. Good customers will be able keep their claims records clean, which can reduce your premiums.

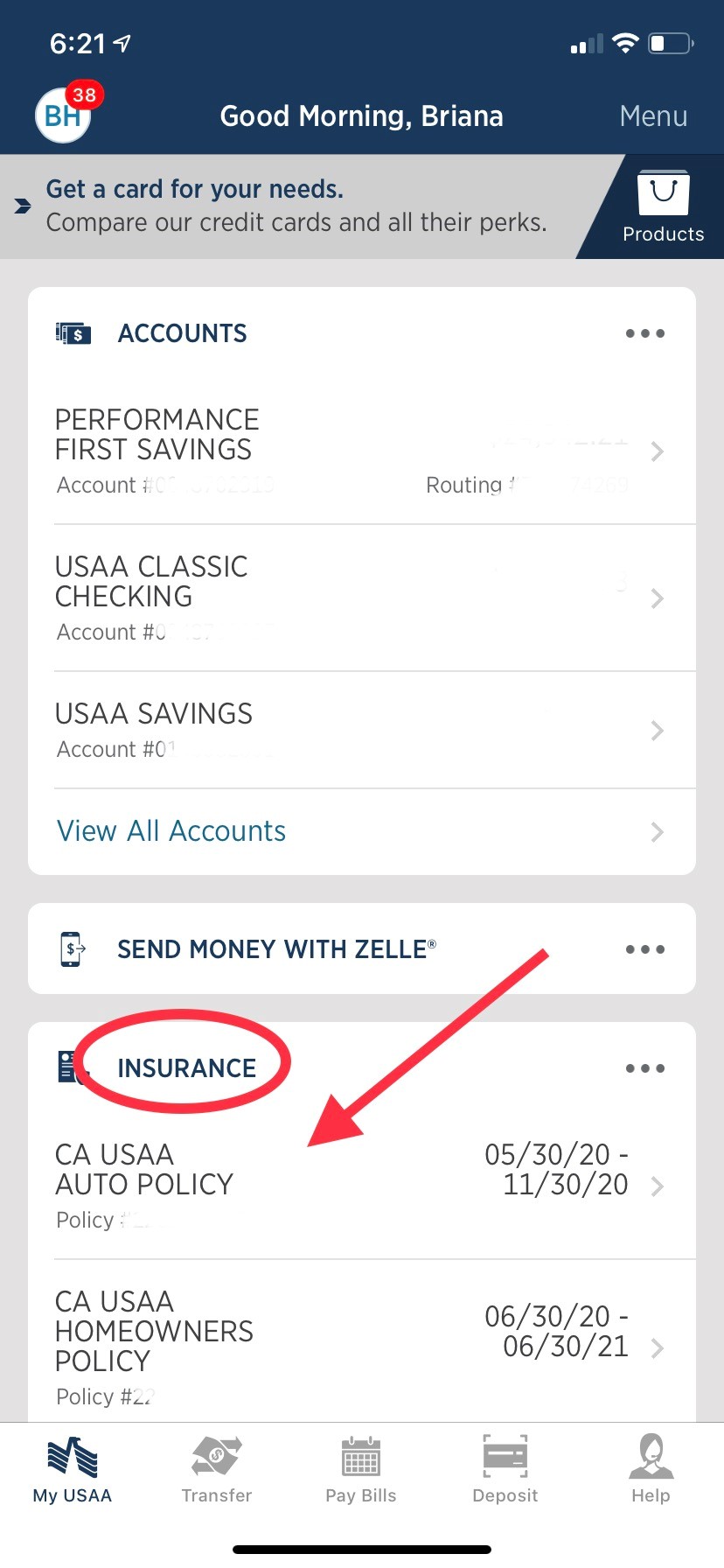

Another smart decision is to insure both your vehicle and your house with the same policy. This will not only help you save money, but it also makes it much easier to track each type of coverage. It also gives you the opportunity to receive discounts that both apply.

Other types of insurance are offered by many home insurance companies. Many insurance companies maintain a list with approved contractors. You may be eligible for discounts if you use certain smart home features. In order to provide discounts, many insurers have partnered with smart device makers. Other companies have a "smart home" program, where customers can receive a free device if they install it.

The most obvious discount is a bundled rate. Numerous insurers offer a bundle rate which is a lower rate for homeowners that insure their car and home with the same company. To get the most out of this discount, you should call your insurer well in advance. Not all insurers will give you a bundled rate, so comparing quotes is always a good idea.

Insurance companies may offer additional discounts for newly built or improved homes. The most significant discount is usually given to homes that have been updated to include a better fire alarm or a security system. Your insurer should be notified of any major renovations or improvements you make to your home. You may not have informed your agent about any major home improvements.

Insurance companies have many other tricks and tips. If you have an electronic home safety system installed, many insurers will offer to lower your premiums. Even if your policy doesn't have a discount, having an alarm or other security feature is an excellent way to protect your family and your home.

Finally, be sure to look for the home insurance discount for your state. These discounts are usually available to homeowners who have been with the carrier for at least 3 years. If your carrier has any special programs, check with them to find out if they offer any for homeowners who have a mobile house, are a member of an HOA, or live in a gated community.

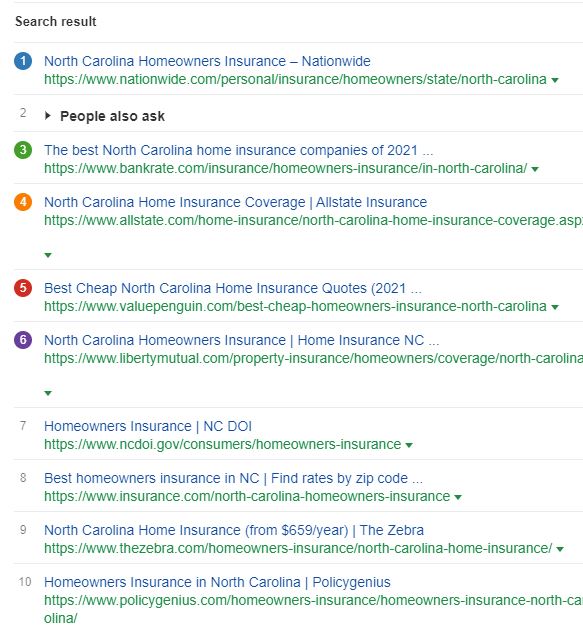

A discount can make a big difference in your monthly spending. You can take a moment to search for discounts in your local area.