There are many options available for Maryland home insurance. Some options might be more expensive than others. For example, Wind mitigation credits may decrease your premiums. You may also want to consider Water backup coverage or Identity theft coverage. All these are great options for homeowners who want protection for their property.

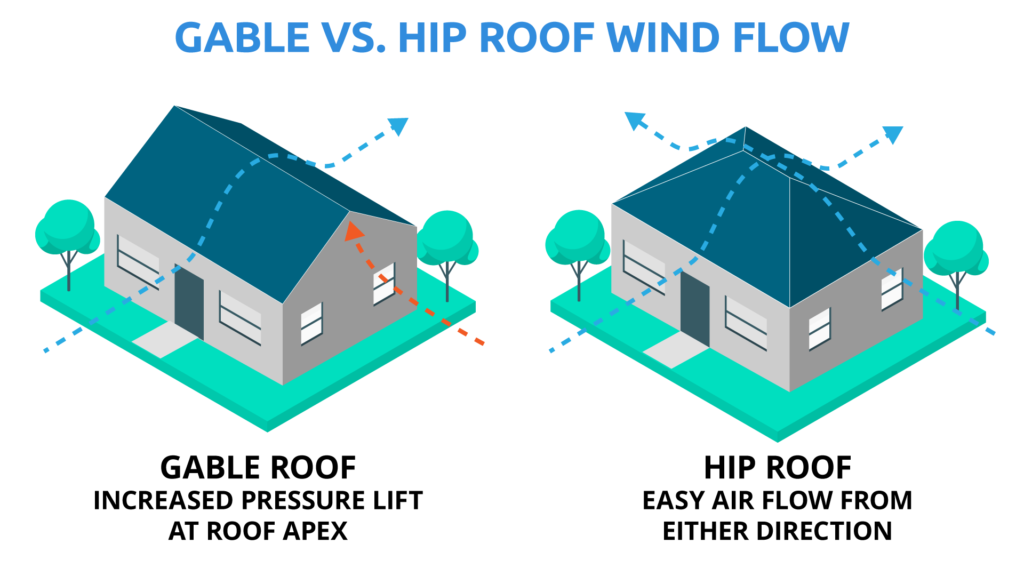

Wind mitigation credits decrease home insurance rates

Wind mitigation credits are a great way to reduce your home insurance premiums in Maryland. These credits can help you save up to 40%. These credits will be granted to homes with wind mitigation features such as storm shutters. These features lower the chance that a home will be destroyed by hurricanes.

Water backup coverage

Maryland homeowners can ensure their safety from sewer backup by obtaining water backup coverage on the policy they have. Maryland law requires insurance companies to offer water backup coverage. This coverage can be purchased in different limits, depending on your insurance needs. The coverage will cover damages to water pipes from water back-up, but not the cost of replacing them or fixing them.

Protect yourself against identity theft

Homeowners who want to safeguard their identity against fraudsters will find it a good option to get identity theft insurance. It can provide legal assistance and resolution services, and reimburses you for any lost wages or expenses incurred as a result of identity theft. Also, make sure you check your credit reports and bank records every month to ensure they aren't compromised. You need to ensure that you have sufficient protection in order to prevent identity theft from happening.

Enjoy Discounts

If you live in Maryland, you may want to look for discounts on home insurance. Certain home features such as a security system or home alarm can be discounted by insurance companies. Also, you may be eligible to lower your monthly premiums simply by choosing a higher deductible.

State Farm

State Farm was established in 1922 by George Jacob Mecherle as a home-insurance company. It offers more then 100 different insurance products. It employs over 58,000 people and 19,000 independent agents to insure nearly 85 million homes across the United States. Their policies include homeowners insurance, renters insurance, condominium insurance, income property insurance, and insurance for manufactured homes, farms, and personal articles.

Travelers

If you live in Maryland, you're probably interested in finding out how much Travelers home insurance costs. They offer coverage for many property types and have several discounts. Your premium may be discounted if your home is environmentally friendly and has a security system. If you own a LEED certified home, you can save even more money by purchasing green materials coverage.