Homeowners insurance is the best way to protect your home and finances. You can avoid costly legal fees if you're sued for damages.

Getting homeowners insurance isn't easy, but there are steps you can take to make it easier and less stressful. Learn about the different types of homeowners insurance, and what they offer. Consider the factors that influence your premium.

Understanding your coverages and limits

Your home insurance should be a well-written, solid document that covers all of your property. This means that you should protect your property against fire, theft, wind and other perils. If you have the right coverages in place and pay a deductible, your insurance may cover damages from natural disasters.

Before filing a claim, it's crucial to know your coverage limits and policy so that you can determine how much you will need to replace any damaged property. This is especially important for valuable items, such as artwork or jewelry, that may not be easy to replace.

Find a low-cost home insurance policy

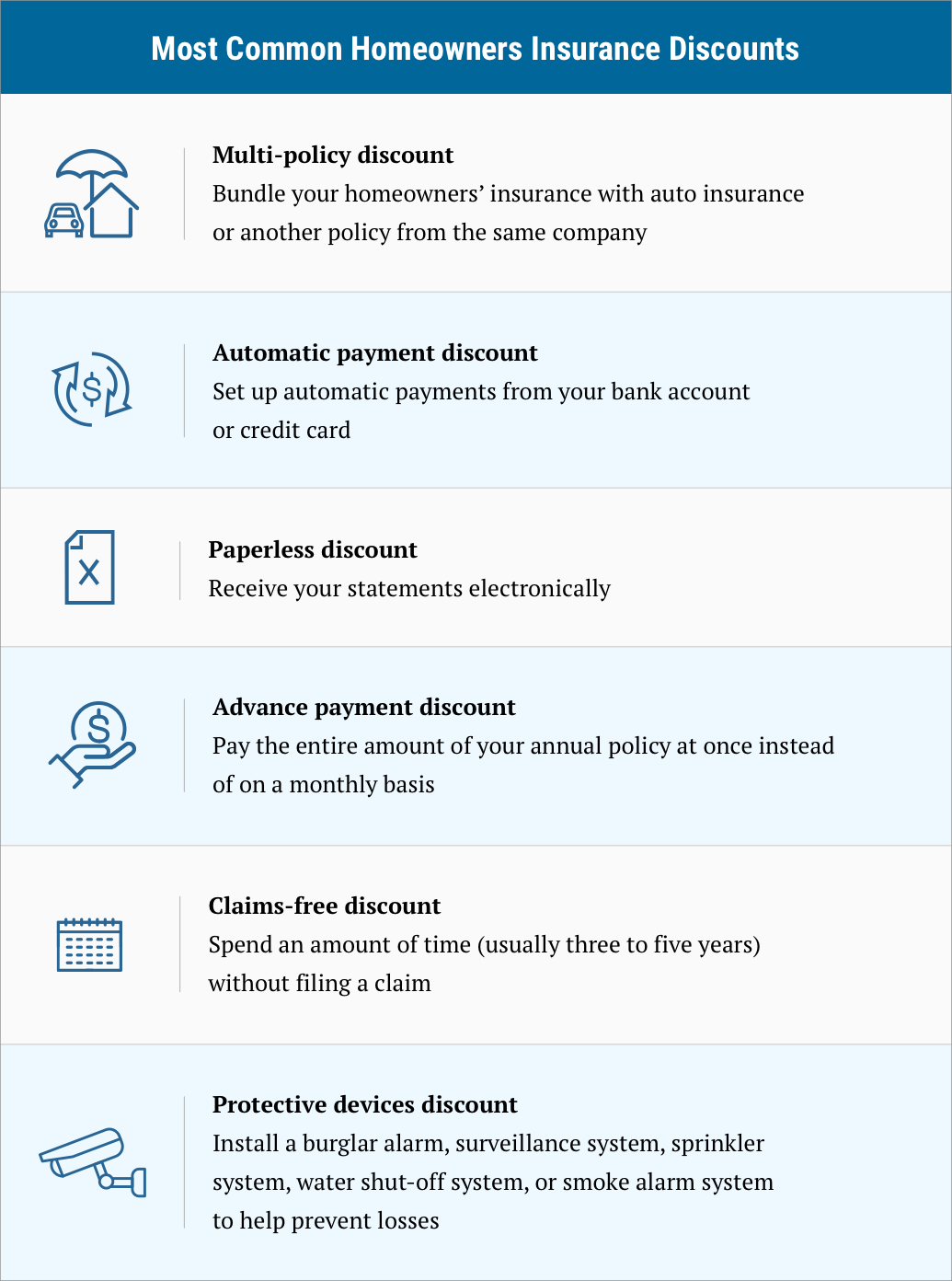

Shop around for the best rates on homeowners' insurance. It is important to be aware that the rate of your homeowners' insurance may change each and every year, due to inflation.

Keep an eye on your premiums by regularly reviewing your policy.

Most insurance companies will add small rate increases every year when renewing their policies, but over time they can add to a significant amount.

Boost your deductibles to lower your monthly payments and keep your premiums affordable.

The higher your deductible, generally, the less out-of-pocket you'll be required to pay if your home is damaged and the more likely you are to not have to file an insurance claim.

Installing security features, fire alarms, and other safety devices can help you reduce your claim risk.

Buy enough homeowners insurance to replace your home and all of its contents if it's damaged by an insured event.

Experts say that the amount you purchase for homeowners insurance depends on both your home's value and its contents. You should have enough insurance to cover your outbuildings such as garages and sheds.

Your agent can determine the amount of coverage you need to have peace of mind if there is a loss.

The amount of your dwelling coverage should be equal to the cost of rebuilding your home using local labor costs and materials.

Additional coverage for your furniture, clothing and personal belongings should be included.

You should not undervalue the importance of taking this step. Two thirds of American households are underinsured.

Buying homeowners insurance isn't easy, but it can be a smart investment in your future. It can protect your biggest asset and help pay for the costs of renting an interim home while you rebuild.