Many homeowners insurance providers claim to offer the best coverage. It is essential to find a company offering the coverage that you need at an affordable price. This can be a difficult task, however. These tips can help you negotiate the best deal.

You should look for homeowners insurance policies with a replacement cost benefit. This is a crucial part of any insurance policy as it covers you in the event your home is destroyed by fire, flood, or other natural disaster. Numerous insurers offer discounts when you install hurricane shutters, or upgrade your electrical systems.

Also, you should look for a deductible that you are able to afford. The deductible is a percentage you pay out of your own pocket before your coverage begins. If you have a $15,000deductible, for example, you only need to pay this amount if you file an insurance claim. You should check your policy at least once per year to ensure you have sufficient coverage.

You'll find many options when you search for the best Illinois homeowners' insurance. Allstate, Travelers and Progressive are well-respected. These companies offer great customer service and have plenty of coverage options.

A major investment is making a purchase of a new house. Insurance is an important part of protecting your investment. While it isn’t required in Illinois it is recommended. Many types of coverage are available, including flood, earthquakes and vandalism.

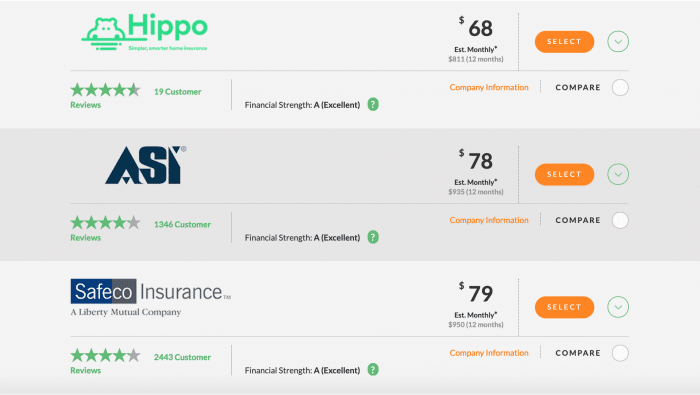

If you're in the market for a new policy, you might want to take a look at the MoneyGeek list of the best home insurance companies in Illinois. This website compares a number of home insurance providers. Based on data from several sources, it weighs the merits of their coverage as well as other features.

It can be difficult to find the right homeowners insurance Illinois. There are many factors that affect the cost of homeowners insurance Illinois, including your home's age, crime rates, and where you live. A good credit rating can help you reduce your costs.

Allstate, which offers an average policy at $1,067 per a year, is Illinois's cheapest home-insurance provider. Another option is the bundled-auto-and-home plan offered by the State Farm. The insurance company has branches throughout the state. Although the name might not sound familiar, the insurance company is still in business since 1864.

Liberty Mutual and USAA are two other notable insurance companies. These two companies are both active in their local communities and have AM Best ratings of A++. These companies offer excellent home and auto insurance that will allow you to save money while still getting the best coverage.

You should also consider using the MoneyGeek homeowners insurance calculator. You can view the most affordable homeowner's coverage Illinois has to offer by using the comparison chart for their homeowner's policy.