Many factors determine the cost of car insurance. You can consider your age, what type of car and driving record you have. It is important to do your research and find the best deal for your needs. Comparing quotes from several companies will help you find the best price.

Cost of Car Insurance In WV

West Virginia is a state where it can be quite difficult to find affordable auto insurance. Fortunately, several companies offer policies at low prices to residents of West Virginia. Moreover, some companies offer discounts for their customers that can help them save on their premiums.

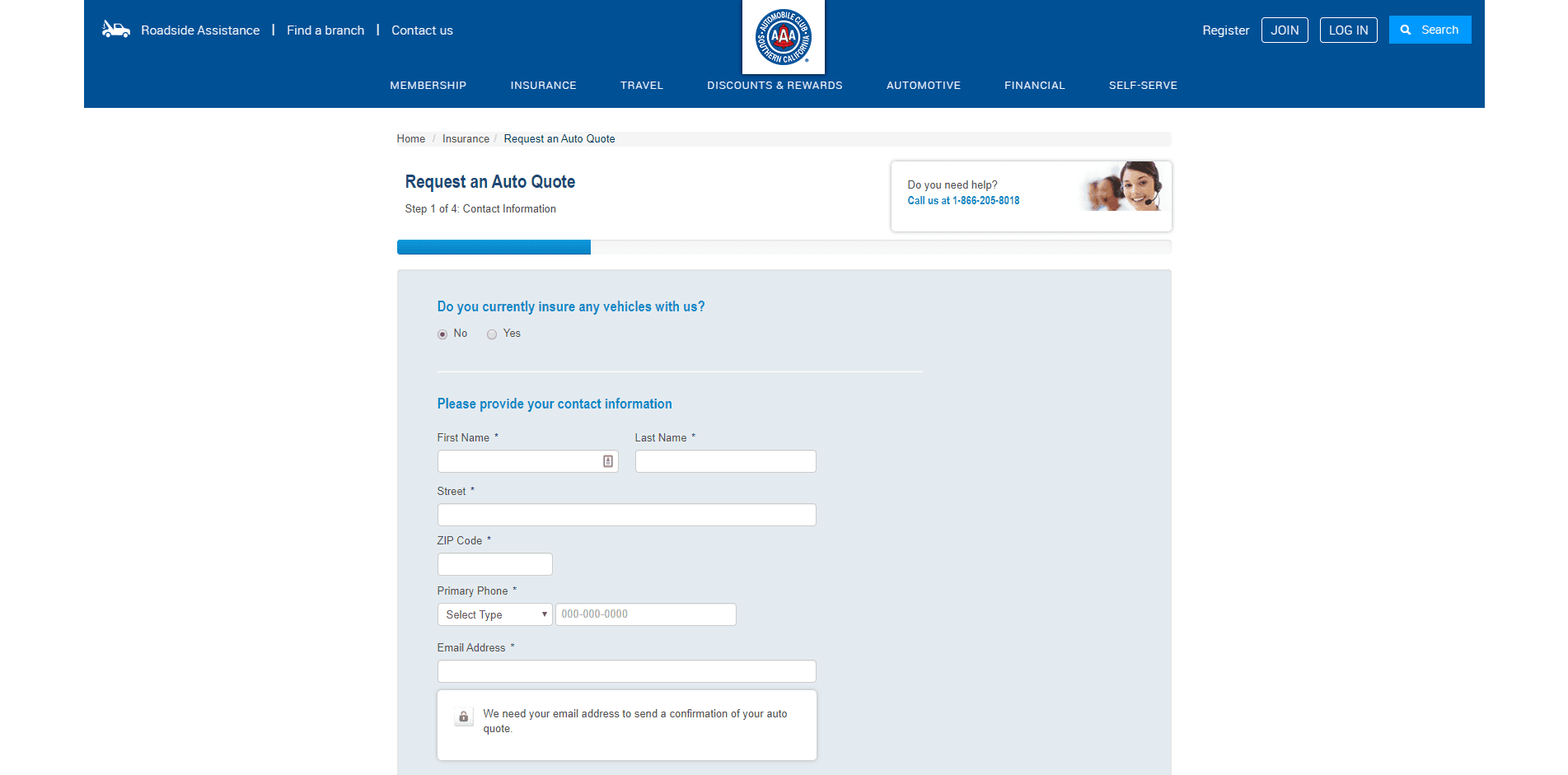

Shopping around for online quotes can be a great way to find low-cost car insurance. Filling in a few forms is all it takes to get multiple quotes. After you receive the quotes, you can decide which company best suits your needs.

The Age of the Driver

The insurance for a new car will be more expensive if you are younger. This is due to the fact that you will have less experience driving a car if your age is younger. You are also more likely to be involved in an accident if you're younger when you purchase a vehicle.

It is important to maintain a clean driving record while you are still young. A clean driving record can help you get discounts on car insurance.

Number of Traffic Tickets on Your Record

Multiple moving violations in your driving record can cost you a lot. West Virginia drivers who receive a traffic ticket pay $197 extra per year on average than those with clean driving records. It is because insurance companies evaluate your risk according to your traffic violations.

In the event that you are convicted for multiple traffic infractions, your insurance rates may increase dramatically. Traffic violations increase your chances of having an accident. And accidents can cause large losses to insurance companies.

Insurance companies look at the surrounding environment as well as your driving behavior when calculating rates. The insurance companies take into consideration where you park the vehicle as well as areas that are prone to high accident or theft rates.

A car accident in which you were at fault can cause your rate to increase. This is because insurance companies disperse risk among their policyholders, so if you have an accident, they will need to raise your premium to offset the increased risk of paying claims.

Get Low Mileage Discount

If you don't use your car that often, you can save on your insurance premium by taking advantage of the Low Mileage Discount. This discount is only available to drivers that commute short distances, and who use their car a couple of times per month.