The cost of car insurance is influenced by many factors, such as your driving record and credit rating. Shopping around is important to find the best prices. Look for discounts that may reduce your premiums.

Missouri law requires auto insurance. It will protect you if there is an accident. The state requires liability coverage for damages caused to another driver's property and bodily injury. The state also requires insurance for uninsured or underinsured motorists.

Minimum requirements in liability, bodily harm, and damage to property are $25,000. This is for one person. The minimum requirement per accident is $50,000. These minimums provide a great starting point. However, you can opt for higher limits and policies that cover all aspects of your insurance.

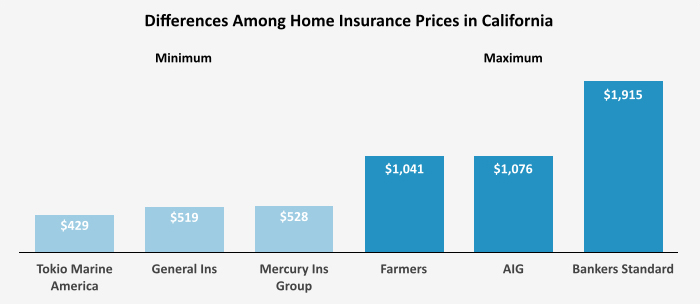

Compare rates from the top Missouri providers

When shopping for car insurance, make sure you compare your options from multiple providers. This can be achieved by requesting multiple quotes from various insurers or using comparison sites.

Missouri auto insurance rates can vary widely depending on the provider. Also, they are affected by various factors. Included in this are the type of vehicle you drive, your score on credit, and where you live.

The cost of insurance is influenced by the level of coverage you choose, such as minimum liability or full coverage. Full coverage, even if it is only required to meet the state's minimum liability, can be an excellent investment, especially if driving a car of high value.

It's important that you compare the coverage types offered by different providers when shopping for car insurance. Some of them include bodily harm, collision, or comprehensive.

You can also add extra protection to your auto insurance by purchasing optional coverages, like uninsured motorists and underinsured drivers. These are designed to cover the costs of any damages that aren't covered by your basic policy.

It is important to select the best car insurance policy in Missouri for your specific needs. You can find a policy that fits your needs and is affordable, regardless of whether you are looking to insure a classic car or only liability.

Your safety and peace-of-mind are dependent on the choice of car insurance you make in Missouri. For the best auto insurance coverage, get a quote online.

Your rate for car insurance is influenced by a variety of factors including your credit rating and claim history. Your car model and annual mileage may also have an impact.

A poor credit score can increase your rates by 62%, on average. Luckily, some carriers offer a discount to those with bad credit.

In Missouri, married and single drivers pay on average 10% less than a driver that is neither married nor single. State Farm, USAA, and USAA have the lowest prices in the state.

Missouri has an average policy cost of $566 a year. This is 5% above the national average.